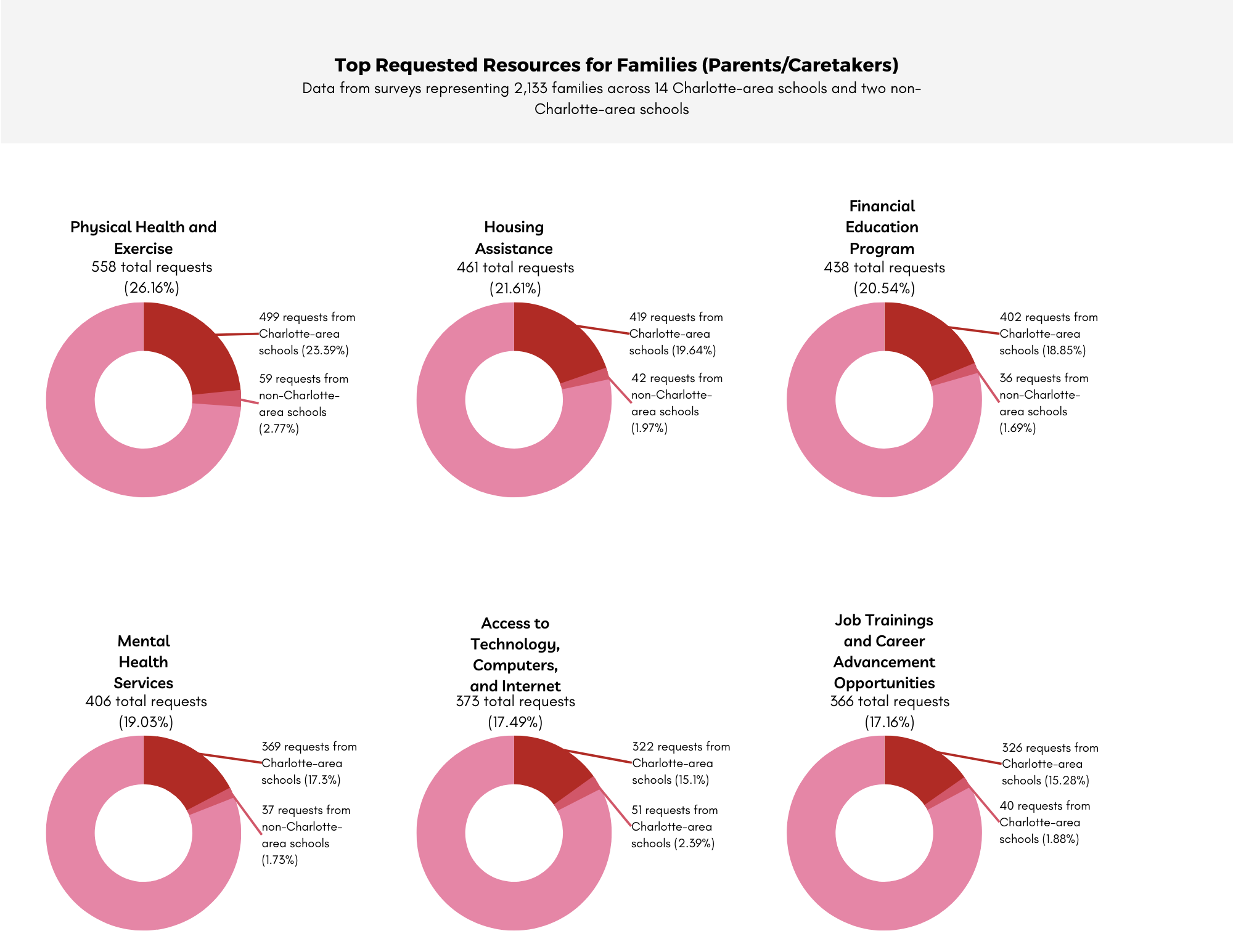

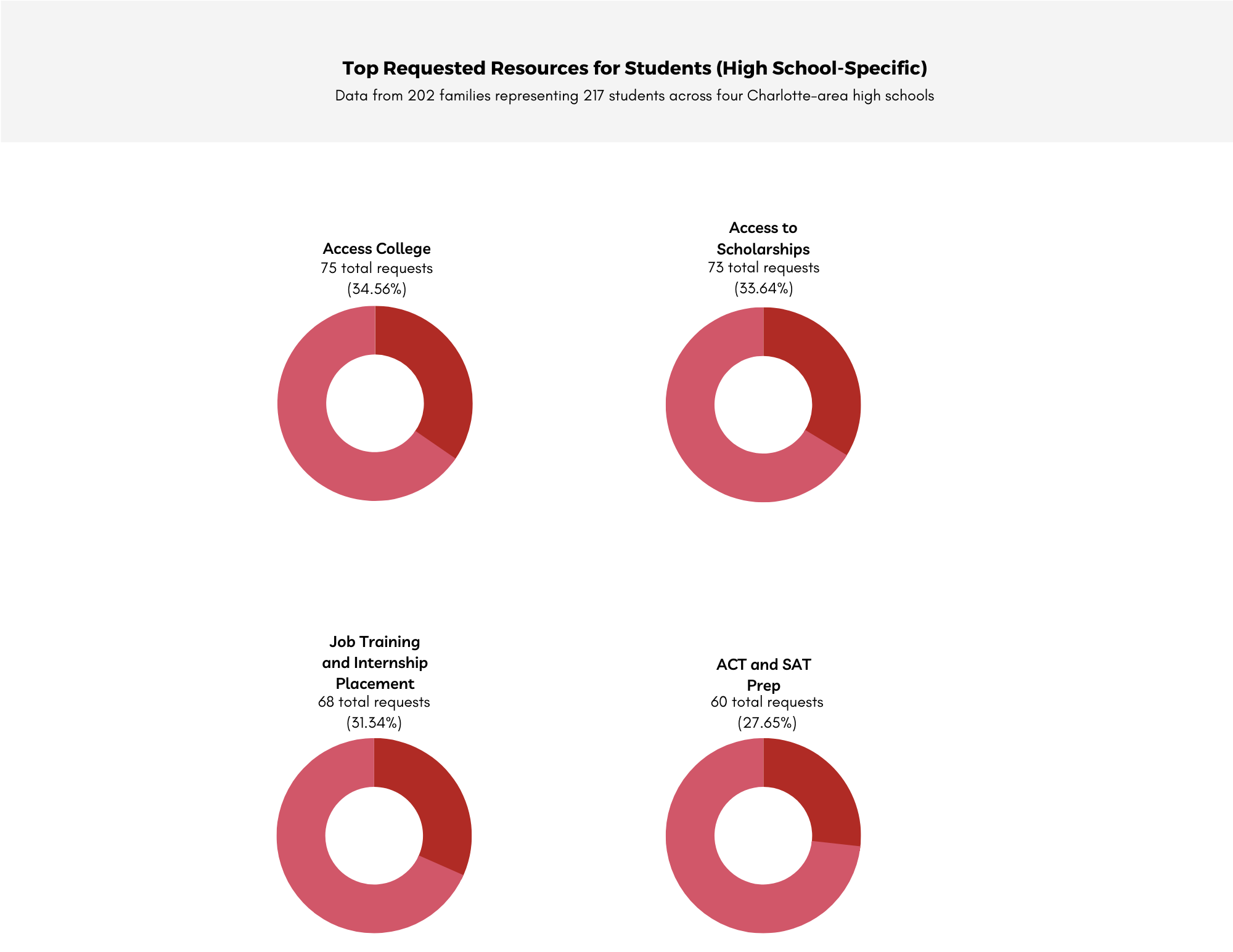

#81 – We analyzed 2,000+ surveys from families across our 16 schools! Here’s what families want!

Written by Jia Lin-Bothe, Director of Family Empowerment

A financial empowerment session at Coulwood STEM Academy, where families worked one-on-one with financial advisors and received valuable information on topics such as budgeting, credit management, saving and investing, and financial planning.

At SchermCo, we believe it is important to hear directly from those we serve and those we seek to serve. To do so, we begin our family empowerment initiatives with our partner schools by conducting a comprehensive survey to understand the needs and wants of the families at those schools.

For context, the family empowerment work was piloted in 2017 with two schools and has grown over the past few years. This school year, we’re working closely with 16 school partners – 14 in Charlotte, one in Durham, NC, and another in Honolulu, HI.

From August to January, we collected a total of 2,198 surveys.

- Out of these 2,198 surveys, we analyzed 2,133 surveys because some families turned in their surveys after our analysis process was completed. However, we did look through their feedback, and these responses were aligned with what other families at their schools reported.

- These 2,133 surveys from families represented 2,963 students, accounting for families with multiple students at their school.

- Out of these 2,133 surveys, 1,874 surveys represented families from our schools in the Charlotte area, representing 2,620 students.

- We distributed both paper and electronic surveys. Out of the 2,198 survey responses, 1,197 responses (56.12%) were completed through paper surveys.

Here is what our families are requesting:

We’re also eager to report that families at our partner schools are looking forward to more in-person events. Based on the above and data from the past few years, we’re noticing a few trends:

We’re also eager to report that families at our partner schools are looking forward to more in-person events. Based on the above and data from the past few years, we’re noticing a few trends:

- For the third year, physical health and wellness resources are one of the top requests from families for both themselves as parents/caretakers and for their students. The pandemic has heightened health awareness and increased the demand for access to health resources and movement-based activities. We also believe that health and well-being influence absenteeism and overall engagement.

In Charlotte and across the nation, housing prices have increased dramatically over the past few years. According to UNC Charlotte’s 2022 State of Housing in Charlotte report, the average cost for a home in September 2022 is $420,000, an increase of 53% from 2020 (at $273,500). The Charlotte Observer notes that Charlotte’s year-over-year rent increase was 17.2% from 2021 to 2022, which exceeds the national average of 15.3%. Additionally, the pandemic caused

- emergency bans on evictions and utility shutoffs. Now that these moratoriums are no longer in effect and with the rising cost of living, housing is a concern for families.

- Similarly, with the rising cost of living and inflation, families are requesting financial education programs to be empowered with the knowledge and skills to manage their money effectively.

- Regarding resources for families to support their students, we see that out-of-school time programs, such as before-, after-, and summer school programs, and homework help and tools are the two priorities. This is likely due to the shift that schools are now back in-person and many workplaces have shifted back to in-office, coupled with staffing shortages among teachers and childcare provides, families have to juggle the transportation needs and the academic needs of their students.

A community resource fair at Idlewild Elementary School, where families connected with community partners, including receiving COVID-19 test kits, flu shots, and COVID-19 boosters.

With all this data in mind, we’re continuing to help families with their economic mobility journeys by providing them with financial education programs and sessions focused on job training and career advancement. As of early February, we’ve already implemented 19 events with our partner schools, bringing out 1,682 attendees, making strides in connecting families with resources and empowering them through financial education workshops:

-

- Idlewild Elementary School hosted their second annual Community Resource Fair back in November. 97 Idlewild parents/caretakers and students connected with 12 community partners focused on health and wellness and out-of-school-time programs.

- Eliminate the Digital Divide (E2D), our community partner supporting families with access to technology, sold 105 laptops at a reduced price to families.

- One attendee pointed out, “Access to laptops was great.”

- The Mecklenburg County Health Department provided families with Covid and flu vaccines.

- Movement School Eastland hosted their annual “Walk It Out” event back in December, where families met with teachers, learned about expectations, and set outlines for routines to prepare for a successful year. We saw that it was only appropriate to follow the curriculum night with a community resource fair since families were already going to be at the school. The fair connected 274 Movement Eastland parents/caretakers and students with 10 community partners focused on housing support, financial education, job training, and out-of-school-time programs.

- At Harding University High School, we took advantage of the school’s “EOC Blitz” for their students and co-hosted empowerment workshops for parents/caretakers while their students were studying for their EOC exams. These workshops focused on providing 23 parents/caretakers information regarding PowerSchool and other platforms the school uses, financial empowerment tools, and mental health counseling. To wrap up the morning, students and parents/caretakers joined together for a yoga and mindfulness session.

- So far, we’ve hosted another three financial education workshops with our partner schools. These workshops were done in collaboration with Common Wealth Charlotte, helping families build increased financial capability by empowering them through trauma-informed financial education. Here are some of the testimonials from attendees:

- Idlewild Elementary School hosted their second annual Community Resource Fair back in November. 97 Idlewild parents/caretakers and students connected with 12 community partners focused on health and wellness and out-of-school-time programs.

- “The session was confirmation that I am on the right track to homeownership.”

- “The 10/10/80 rule was a helpful concept to learn about.”

- “[I found most useful from the event] what percentage of income to put where.”

- “La importrancio de tener crédito.” (The importance of having credit.)

- “Descubrir y revisar mis informes de crédito con Experian, Equifax y Transunion.” (Discovering and reviewing my credit reports with Experian, Equifax, and Transunion.)

A community conversation about mental health at University Park Creative Arts School, where families learn about mental health issues and ways to promote recovery. Families discussed with each other ways they could support each other.

We’ll be co-hosting and co-implementing at least another 25 events through the end of the school year, focusing on connecting families with the resources they need and guiding them through their economic mobility journeys.

More to do, More to come!

Action Item:

Interested in joining our cohort of school partners for the upcoming school year? Join us at our upcoming webinar on February 21st to learn more!

Leave a Reply

Want to join the discussion?Feel free to contribute!